Child Tax Credit 2024 Increase Income – A new tax bill aims to increase access to the child tax credit for lower-earning families — but it’s much less generous than it was in 2021. . If you have a child — even one that was born in 2023 — you may be eligible for the child tax credit. If you qualify, the credit could reduce how much you owe on your taxes. As of right now, only a .

Child Tax Credit 2024 Increase Income

Source : itep.org

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit: Income Limits for Eligibility Increased The Hype

Source : www.thehypemagazine.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

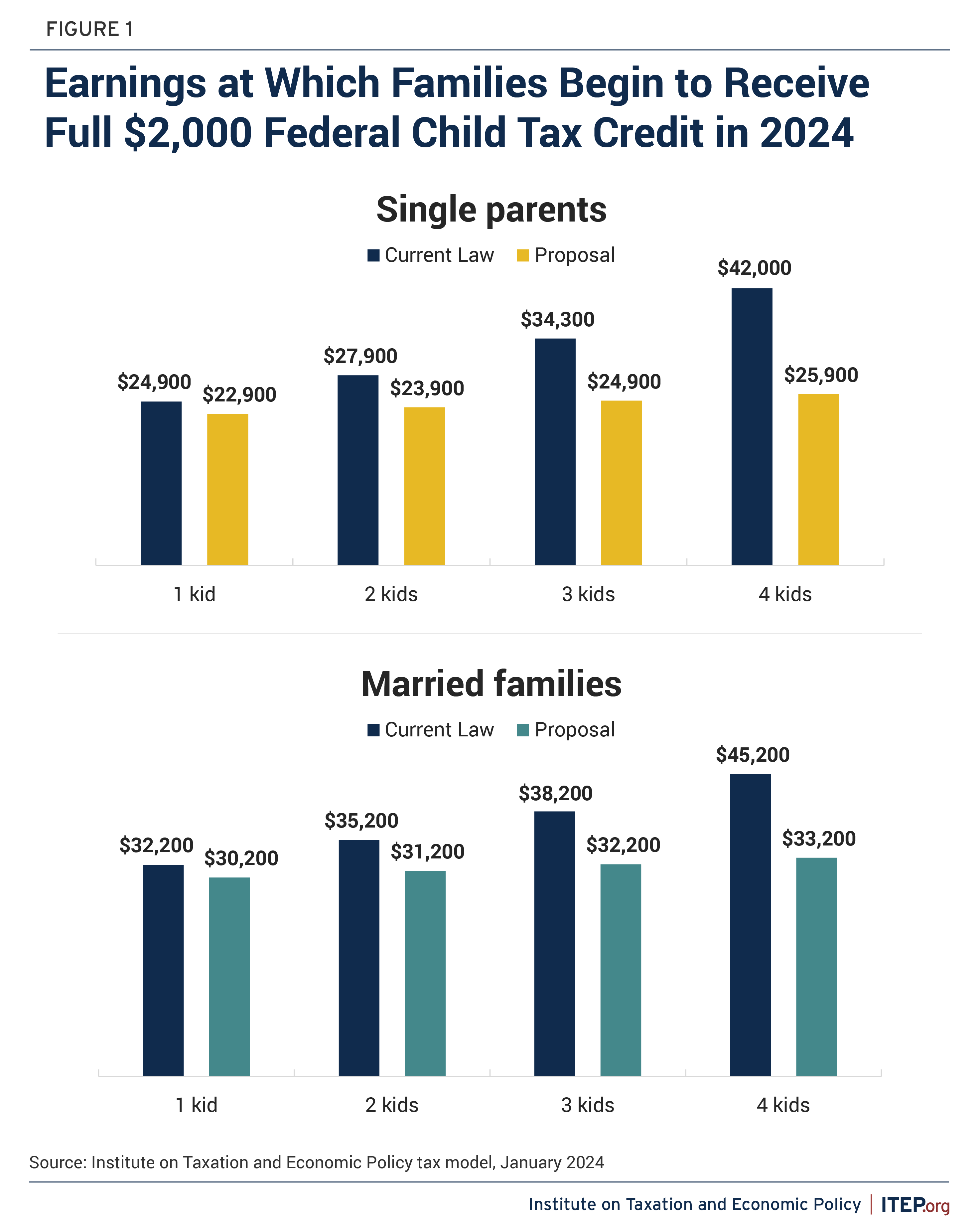

Child Tax Credit 2024 Increase Income Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. . Currently, only middle- and upper-income families receive the full $2,000 credit per child. That is because the credit reduces taxes owed and is not fully refundable, meaning many low-income families .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)